Posted above is what a Facebook page called Americans against the Republican Party posted up about Socialist Insecurity. Based upon this meme you would almost think that progressives and fellow socialists actually believe in free choice instead of forcing fellow citizens to give up the majority of their income. Based upon how often the Democratic Party Presidential candidates talk about the 1%, taxing the rich, demanding that the Federal Government provide more, and their desire to turn the United States into a copy of Denmark I’m not certain I wouldn’t believe that though. Let’s take a look at some of the comments from the aforementioned Facebook page:

The comments are very revealing into what many progressives believe. The socialists are admitting that: they’re socialists, discuss why socialism is a good thing, think that the government will fix their problems, Rethuglicans are opposing the glorious coming of Next Tuesday™, and that progressives care about proles citizens. Don’t forget to talk about fighting for change some more either. Progressives care about you so much that they’ll take your income, give it to someone else, and then promise to pay you back with interest decades later. Obviously citizens can’t be trusted to save up their own money.

Plenty of people think that the Federal Government needs to provide even more for citizens and make things “free.” Going back to the Bernie Sanders’ article I linked to earlier:

“Health care in Denmark is universal, free of charge and high in quality. Everybody is covered as a right of citizenship. The Danish health care system is popular, with patient satisfaction much higher than in the United States. In Denmark, every citizen can choose a doctor in their area. Prescription drugs are inexpensive. ”

It’s interesting that socialists will claim that anything a government provides is free. Danish taxes include: income taxes (not including municipal, and others) starting off at about 38% for anyone making over 40,000 DKK (∼$7000 US), a national Value Added Tax of 25%,a 180% sales taxes on automobiles (some boast about it since citizens’ are forced into obedience concerning climate change), $2,000 fees just to get a Driver License, gas taxes over $4/G, and numerous other fees. Such taxes hardly qualify anything provided in Denmark as being “free” and of no expense to taxpayers. But hey, taking 2/3 or more of a citizens income and and controlling them is a socialist’s wet dream right? Even when the extreme taxes are pointed out to progressives, they’ll still call government programs free. No matter what you use to prove that extensive social programs require extensive taxes, they’ll simply reply back that the rich aren’t paying their fair share…

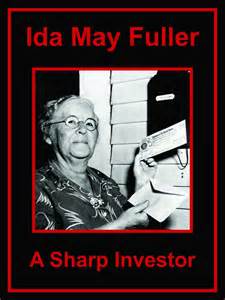

Back to the initial thrust of this post though; no matter what progressives say about Social Security, not everyone pays into it. For quite a large number of people, including Ida May Fuller (more on her later), almost nothing was contributed to the “Trust Fund.” Let’s look at what Michael Lind had to write in the New York Times article “Social Security as a Ponzi? It’s a Bad Metaphor“:

“Some critics of Social Security seem to equate it with a Ponzi scheme because the growth of payouts depends on growth of the number of future taxpayers, in the case of Social Security, or future investors, in the case of classic Ponzi schemes. By this definition, Social Security is a Ponzi scheme — and so are the private investment accounts that many conservatives propose as an alternative to Social Security. Whether the intermediary is the government or private money managers, in both cases the income of retirees will depend on money generated by the economic activity of succeeding generations in the work force. The main difference is that private investments are riskier than promises by the federal government of the United States to pay benefits to seniors who have paid payroll taxes all their lives.“

The author just admitted that Social Security is a Ponzi scheme. I do not advocate for forcing people to put money in private investment accounts either. I simply believe that citizens shouldn’t forcefully have 6.2% (up to $118,500) of their paycheck deducted, nor should employers have to give up their 6.2% either. I feel as if I can manage money better than central government managers, but progressives can’t let people have freedom. They have to take your money for your own good.

“Social Security was partly pre-funded in 1983. This raised payroll taxes above immediate program costs in order to create a trust fund that lent money to the U.S. government, which must repay the trust fund as any other creditor would. Social Security will not become a pure pay-as-you-go system until 2036, according to the latest government estimates. Even then, there will be only a modest shortfall in benefits, which can be eliminated in advance by higher payroll taxes, permanent infusions of general revenue or other non-payroll taxes, or benefit reductions — or a combination of these reforms. A Social Security system funded purely by current taxes would no more be a Ponzi scheme than the U.S. military or the public school system.“

So the Federal Government can take money out of it and promise to pay it back? Sounds promising. The estimates he posted up are also not correct. I can’t verify what he actually linked to, it is now dead. Taking a look at a report by the Office of the Inspector General for the Social Security Administration’s 2014 Disability Insurance Trust Fund Informational Report reveals the following:

“The 2014 Trustees’ Annual Report has projected that the DI Trust Fund reserves will be depleted in the fourth quarter of 2016, and the combined OASI and DI Trust Funds would be depleted in 2033. Although the DI Trust Fund is estimated to be depleted in the fourth quarter of 2016, the Trustees have recommended that lawmakers address the projected Trust Fund shortfalls for the combined OASI and DI Trust Funds in a timely way to phase in necessary changes and give workers and beneficiaries time to adjust to them. Implementing changes soon would allow more generations to share in the needed revenue increases or reductions in scheduled benefits.“

For anyone who’s curious, DI refers to the Disability Insurance Trust Fund and OASI is Old-Age and Survivors Insurance program. The DI “Trust Fund” runs out of money in a year and once the program payments are combined money will run low in 2033. Isn’t interesting how these estimates keep growing shorter? Moving down to page 3, the document illustrates perfectly how Social Security is a pyramid scheme:

“Overall, OASDI costs will rise over the next 20 years as baby boomers retire and lower-birth-rate generations born after 1965 replace the population at working ages. The lower birth rates after 1965 caused a permanent shift in the population’s age distribution, with fewer workers supporting more retirees. Additionally, the baby boomer generation has moved from less disability-prone ages (25 to 44) to more disability prone ages (45 to 64). See Figure C–1 in Appendix C. This, along with other issues, has resulted in the flat projected number of workers per DI beneficiary for the future.“

The last paragraph in Mr. Lind’s piece must have been a joke, right?

“To paraphrase the late David Crockett — as a U.S. congressman from Tennessee, before he died in 1836 at the Alamo during the fight for the independence of Texas — Governor Perry’s claim that Social Security is a Ponzi scheme don’t make good sense. It don’t even make good nonsense.“

Something doesn’t make sense anyway. The fine fact-checkers over at PolitiFact Florida have declared any claims that Social Security is a Ponzi scheme to be false. Let’s take a look at why:

“The term originates with Charles Ponzi, a Boston swindler who conned investors out of millions in 1920 by promising returns of up to 100 percent in 90 days on investments in foreign postal coupons. After first-round investors harvested those profits, others flocked to Ponzi, unaware his ‘profits’ consisted of money paid in by other investors.

That strategy is unsustainable.

In contrast, Social Security is more like a ‘pay-as-you-go’ system transferring payroll tax payments by workers to retirees. A 2009 Social Security Administration online post stated: ‘The American Social Security system has been in continuous successful operation since 1935. Charles Ponzi’s scheme lasted barely 200 days.’”

It’s different from a Ponzi scheme because it’s lasted thus far. It’s different because rather than my own money coming back to me it’s going to someone else. What sound logic. Continuing on:

“Mitchell Zuckoff, a Boston University journalism professor who has written a book on Ponzi, noted three critical dissimilarities between Social Security and a Ponzi scheme. We will summarize Zuckoff’s comments from an earlier fact-check:

• ‘First, in the case of Social Security, no one is being misled,’ Zuckoff wrote in a January 2009 article in Fortune. ‘Social Security is exactly what it claims to be: A mandatory transfer payment system under which current workers are taxed on their incomes to pay benefits, with no promises of huge returns.’

• Second, he wrote, ‘A Ponzi scheme is unsustainable because the number of potential investors is eventually exhausted.’ While Social Security faces a huge burden due to retiring Baby Boomers, it can be and has been tweaked, and ‘the government could change benefit formulas or take other steps, like increasing taxes, to keep the system from failing.’

• Third, Zuckoff wrote, ‘Social Security is morally the polar opposite of a Ponzi scheme. … At the height of the Great Depression, our society (see ‘Social’) resolved to create a safety net (see ‘Security’) in the form of a social insurance policy that would pay modest benefits to retirees, the disabled and the survivors of deceased workers. By design, that means a certain amount of wealth transfer, with richer workers subsidizing poorer ones. That might rankle, but it’s not fraud.’”

I see why Social Security has lasted for decades now. You pay into the system or you get to go to prison for tax evasion. The journalism professor wrote that there’s no huge returns, even though the Democratic Presidential candidates keep claiming that they’re going to have the Federal Government give out more “free” stuff. It’s not fraud because you don’t have a choice. Yet more sound logic.

In PolitiFact’s own article they essentially admit that Social Security is a Ponzi scheme that forces you to pay rather than going out of business.

“Michael Tanner, an expert on Social Security at the libertarian Cato Institute says that Social Security and Ponzi schemes share some characteristics — for example, in the early stages there is a huge windfall while those later on get smaller returns.

However, Ponzi didn’t have the power of the federal government.

‘In the end the Ponzi scheme collapses and can’t make people continue to give him money, but Social Security can always force people to pay,’ Tanner said. ‘In theory Social Security can always go out and raise taxes to keep benefits flowing.’”

PolitiFact still rates the claim that Social Security is a Ponzi scheme as being false though:

“Curbelo said that Social Security and Medicare are ‘a Ponzi scheme.’

A Ponzi scheme is by definition an illegal crime and an unsustainable set-up that crashes very quickly. Social Security and Medicare, which have been around for decades, are not criminal schemes.

Both programs face the massive challenge of fewer workers paying for the benefits of current retirees, and budget experts say Congress could make changes to make them more sustainable in the future — though many politicians are reluctant to gamble with the support of current senior voters.

Curbelo raises a legitimate point about the need for reform, but that’s entirely different than calling these programs ‘Ponzi schemes.’

We rate this claim False.”

Social Security is legal because FDR did everything possible to circumvent the Constitution and pack the Supreme Court. Social Security is legal because you don’t have a choice. Progressives have some interesting ideas on freedom and what is illegal.

Earlier in the article I mentioned Ida May Fuller, the first recipient of a monthly Social Security check. Ms. Fuller paid a grand total of $22.54 into Social Security and received $22,888.92 in benefits. There’s really not much that I can to say to anyone that thinks such a system is sustainable. She multiplied her contribution a thousand times over; what a fine investment! The SSA seems to be gloating over how much money Ms. Fuller received. I guess we’ll just keep kicking the debt can down the road for now. As always, share this post with your friends and comment.