One of the least thought out memes that I’ve come across lately comes from a lady who calls herself The Bitchy Pundit. Here are her thoughts on how the U.S. Federal Budget is spent:

There are some easy ways to counter the sheer stupidity of this picture. The Congressional Budget Office produces plenty of fine information about the state of the U.S. Federal budget. I’ll be citing some data from the following publication: The Budget and Economic Outlook:2015-2025. On page 66 it is shown that for FY 2014 the total budget was about $3.5 trillion, with Mandatory spending taking up about $2 trillion. Such spending covers programs like: Social Security, Medicare, Medicaid, and health insurance subsidies. Discretionary spending was about $1.2 trillion; of that about $600 billion went to Defense spending while the other approximately $600 billion went to miscellaneous funding such as: transportation and infrastructure, education, and various research programs, amongst many other projects. The discretionary spending data can be found on pages 82 and 83.

So, unless there’s a $10 trillion item on the budget specifically meant for corporate subsidies that isn’t mentioned in the CBO report (or in any budget document for that matter), this number is not actually based on real data and is just some statistical hyperbole. There are two sources mentioned at the bottom of the picture, one from the White House’s website and the other from a progressive website called CommonDreams. Let’s take a look at what’s there.

The White House link is a calculator where you type in the taxes you paid last year to illustrate how your taxes are spent. Here are the results based on current tax levels for an individual earning $50,000 per year:

Based upon this picture, no single item actually reaches $4,000 and corporate subsidies are not listed anywhere on the webpage. I’m also not certain how Bitchy Pundit acquired her numbers for Medicare (2.9% tax, half paid by the employee), the Military, or really any spending since they don’t seem to match up to what is listed by the data on the White House tax receipt webpage. It seems safe to say that this citation is at best, severely distorted by Bitchy Pundit.

Moving on the to CommonCommunism CommonDreams article by Paul Buchheit leads an article that claims the average household pays about $6,000 every year in corporate subsidies. Once again, the data presented on the picture isn’t the same as it is in the citation. In this case, it’s supposedly even worse but let’s take a few minutes to analyze the claims in this article. Here’s the first claim that the author makes:

“The Cato Institute estimates that the U.S. federal government spends $100 billion a year on corporate welfare. That’s an average of $870 for each one of America’s 115 million families.”

This one is true and I agree that it needs to go down. The Federal Government never should have subsidized failures like Solyndra. Let’s take a look at the next statement:

“It does include payments to 374 individuals on the plush Upper East Side of New York City, and others who own farms, including Bruce Springsteen, Bon Jovi, and Ted Turner. Wealthy heir Mark Rockefeller received $342,000 to NOT farm, to allow his Idaho land to return to its natural state.”

I also agree with this point, progressives like Bruce Springsteen shouldn’t get paid by money from the Federal Government because they have farms. I would also further state that People’s Hero FDR never should have created the Agricultural Adjustment Act to pay farmers not to grow crops.

Enough of making fun of that no-talent hack Springsteen, lets move onto the next part of the argument:

“It also includes fossil fuel subsidies, which could be anywhere from $10 billion to $41 billion per year for research and development. Yet this may be substantially underestimated. The IMF reports U.S. fossil fuel subsidies of $502 billion, which would be almost $4,400 per U.S. family by taking into account “the effects of energy consumption on global warming [and] on public health through the adverse effects on local pollution.” According to Grist, even this is an underestimate.”

I took a look at the IMF publication and it’s very apparent that the half-trillion figure is for the entire world, not the U.S. specifically. This is made apparent throughout the paper, but here are some screenshots for those who aren’t interested in reading the entire report:

I’m not certain how the author came up with a figure of $502 billion. The author either made up the number and didn’t actually read the report or is simply lying. Next!

“The subsidies mentioned above are federal subsidies. A New York Times investigation found that states, counties and cities give up over $80 billion each year to companies, with beneficiaries coming from …”

The Koch Brothers would agree, the market should actually be free rather than manipulated by the government. That being said, a subsidy can simply be a company paying less in taxes and not just the government giving money or land away. The Bitchy Pundit is conflating what your tax bill is with what she wants corporate taxes to be, which is simply dishonest. What if the government just lowered (or eliminated) many taxes, got rid of subsidies, and simply spent less money. Clearly, government distortion and command of the economy is a real winner. Let’s take a look at the next excerpt from this article:

“According to the Huffington Post, the “U.S. Government Essentially Gives The Banks 3 Cents Of Every Tax Dollar.” They cite research that calculates a nearly 1 percent benefit to banks when they borrow, through bonds and customer deposits and other liabilities. This amounts to a taxpayer subsidy of $83 billion, or about $722 from every American family”

I took a look at the Huffington Post article and it’s another obfuscation of the data. The $83 billion figure is not a direct subsidy, the banks mentioned aren’t actually getting tax breaks. One part of the Huffington Post article is a bit more pertinent though:

“Let’s start with a bit of background. Banks have a powerful incentive to get big and unwieldy. The larger they are, the more disastrous their failure would be and the more certain they can be of a government bailout in an emergency. The result is an implicit subsidy: The banks that are potentially the most dangerous can borrow at lower rates, because creditors perceive them as too big to fail.

Lately, economists have tried to pin down exactly how much the subsidy lowers big banks’ borrowing costs. In one relatively thorough effort, two researchers — Kenichi Ueda of the International Monetary Fund and Beatrice Weder di Mauro of the University of Mainz — put the number at about 0.8 percentage point. The discount applies to all their liabilities, including bonds and customer deposits.”

I took a look at the IMF Working Paper referenced and no specific U.S. banks are mentioned. That means the government controlled loan giants of Fannie Mae and Freddie Mac counted towards this bailout/implicit subsidy figure. The Huffington Post article claims: “The top five banks — JPMorgan, Bank of America Corp., Citigroup Inc., Wells Fargo & Co. and Goldman Sachs Group Inc. – – account for $64 billion of the total subsidy, an amount roughly equal to their typical annual profits …“. The Huffington Post article is making a claim that’s not substantiated by the data in the IMF Working Paper or presented in the article at any point. Besides, since when did progressives oppose bailouts? I wonder if Mr. Buchheit would support ending the Federal Reserve?

Our fine author then goes on to call bank and retirement fund fees a subsidy:

“This was a tough one to calculate. Demos reports that over a lifetime, bank fees can “cost a median-income two-earner family nearly $155,000 and consume nearly one-third of their investment returns.” Fees are well over one percent a year.”

I don’t understand how bank fees can be construed as a subsidy that taxes support. If you don’t want to pay excessive trading fees, don’t be a day trader. If you don’t want to spend money on actively managed mutual funds, pick stocks yourself or buy a mutual fund that is not actively managed. Fees associated with your accounts will be listed in the terms and if you don’t like them find a cheaper investment. I wonder if the author is in favor of a low Capital Gains Tax? Might reduce the fees that Mr. Buchheit is decrying so much.

In the next bullet point, the author calls patent laws a tax subsidy:

“According to Dean Baker, “government granted patent monopolies raise the price of prescription drugs by close to $270 billion a year compared to the free market price.” This represents an astonishing annual cost of over $2,000 to an average American family.

OECD figures on pharmaceutical expenditures reveal that Americans spend almost twice the OECD average on drugs, an additional $460 per capita. This translates to $1,268 per household.”

Does the author want to end all patent laws, or just for prescription drugs? There’s no reference for the $270 billion figure, so I can’t easily verify this claim based on the links provided. I haven’t really studied what effects that eliminating patent laws would have on the ability of pharmaceutical and biotech companies to recuperate their costs of research and development. Would the U.S. remain a leader in developing new drugs to begin with? The Center for Economic and Policy Research article cited glosses over a lot of applicable details. As far as the amount of money spent by U.S. citizens on pharmaceuticals, is it simply due to the over-prescription of drugs? Do the people of countries where the spend less on drugs really spend less if it’s their own tax dollars paying for said drugs? Funny enough, the OECD report contains data that shows Americans pay less than the OECD average out of pocket for medications. I wonder if Mr. Buchheit would support ending Medicare, Medicaid, and Social Security? People would never try to commit fraud against those programs. Perhaps if the U.S. didn’t have so much government controlled healthcare prices for medical care wouldn’t be rising so drastically?

Point six is just a repeat of the first bullet point in the article:

“We’ve heard a lot about tax avoidance and tax breaks for the super-rich. With regard to corporations alone, the Tax Foundation has concluded that their “special tax provisions” cost taxpayers over $100 billion per year, or $870 per family. Corporate benefits include items such as Graduated Corporate Income, Inventory Property Sales, Research and Experimentation Tax Credit, Accelerated Depreciation, and Deferred taxes.”

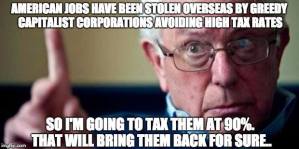

Then there’s the progressive plan of convincing companies to keep their money in the U.S. by taxing them at 39% is an idea that surely wouldn’t backfire:

“U.S. PIRG recently reported that the average 2012 taxpayer paid an extra $1,026 in taxes to make up for the revenue lost from offshore tax havens by corporations and wealthy individuals. With 138 million taxpayers (1.2 per household), that comes to $1,231 per household.”

I find it interesting that progressives claim that it’s selfish to want to keep your own money yet selfless to vote to take away 90% or more of someone else’s income. I would posit that people who are willing to have the government take the majority of and individuals income is more greedy than someone who simply wants to keep what they earned. Would the author support a Flat Tax or Fair Tax? Either one couldn’t possibly be convoluted as the current tax system and would have far fewer loopholes. “Corporate greed” is a problem for progressives, but giving them extremely high taxes won’t continue to push them to take their money out of the country? The only country that even has a higher national corporate tax rate than the U.S. is the United Arab Emirates. Once again, this is not actually on your tax receipt. Also, how much do rich progressives shirk their taxes? What does comrade Buffett think?

Here’s how Mr. Buchheit closes out his article:

“Overall, American families are paying an annual $6,000 subsidy to corporations that have doubled their profits and cut their taxes in half in ten years while cutting 2.9 million jobs in the U.S. and adding almost as many jobs overseas.

This is more than an insult. It’s a devastating attack on the livelihoods of tens of millions of American families. And Congress just lets it happen.”

I think that I’ve shown that such statements are false. Mr. Buchheit’s lies and misrepresentation of the data is an insult to my intelligence.